With the RBA in rate-cut mode, commodities hovering around the lows, and China stuck in a soft patch — most people would think the outlook for the AUDUSD would be fairly grim. But there’s a few key reasons to anticipate upside here.

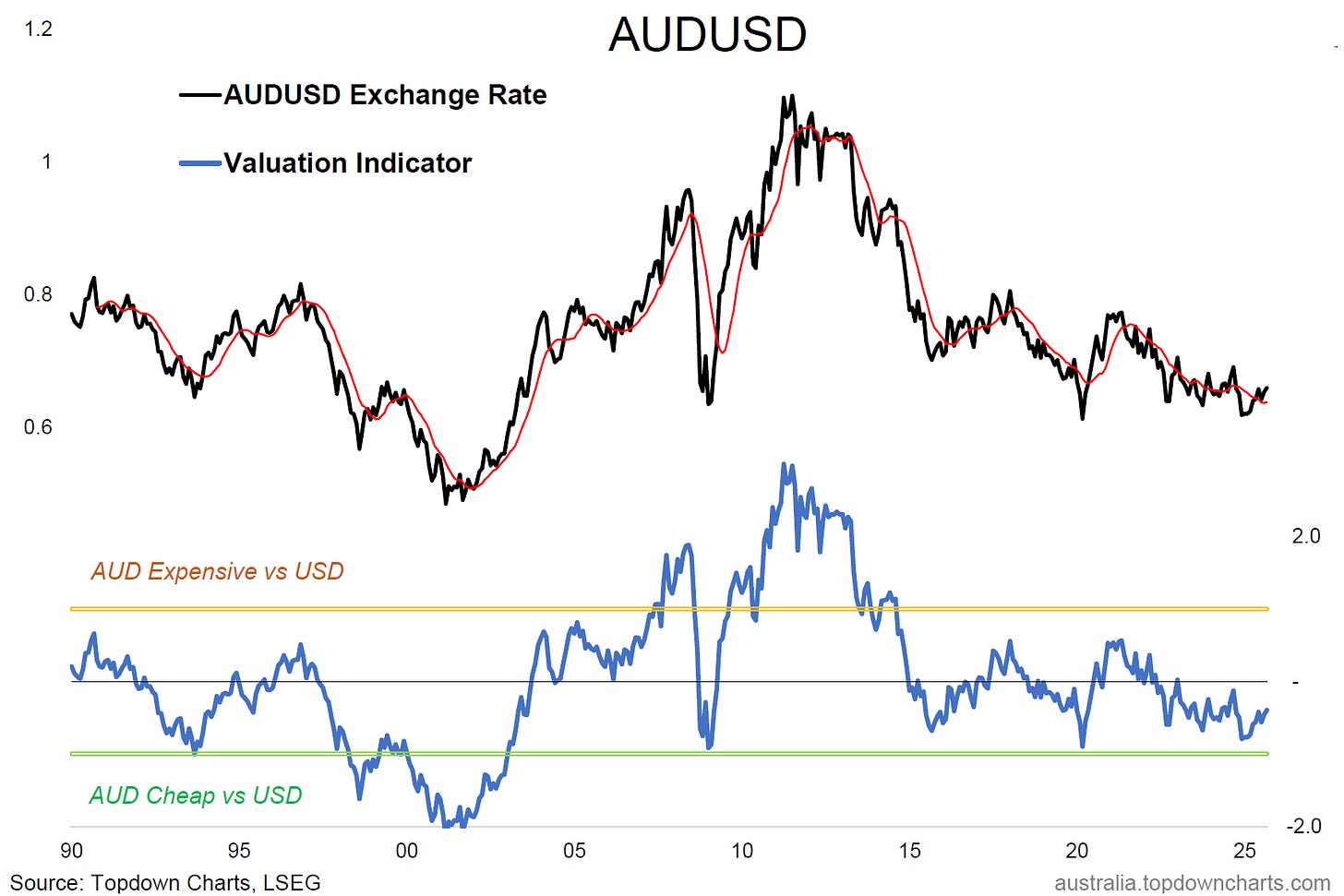

The valuation indicator* [pictured below] for the AUDUSD exchange rate is ticking up from its cheapest level since 2020.

The AUDUSD itself has been trending up off the April 2025 lows, and like many other markets —the tariff tantrum and volatility of H1 appears to have served as a healthy reset and bullish turning point.

Although it still needs to get through short-term overhead resistance, the combination of cheap valuations, crowded short futures positioning (contrarian bullish signal), and in my view a bullish outlook for commodities (and bearish outlook for the US dollar in general) makes for a bullish setup for the Aussie dollar here.

Key takeaway: The AUDUSD appears to be going through a bullish turning point.

*(the valuation indicator is a z-score and measures a combination of AUDUSD deviation from PPP valuations & long-term averages)

This note was brought to you by the Australian Market Valuation Book service by Topdown Charts.

About the Australian Market Valuation Book

The Australian Market Valuation Book features exclusive, innovative, and insightful indicators to provide Clarity and Decision support to Australian investors +those who allocate-to or are interested in understanding this market.

Specifically, the pack covers:

Australian Equities (ASX 200, Small Ords, Banks, Resources, sectors, AREITs).

Australian Fixed Income (corporate credit, government bonds, rates)

Other key markets (AUDUSD, A$ Gold, housing)

Capital Market Assumptions (expected returns for the major assets)

The pack focuses on delivering insight into:

Valuations: is the market cheap/expensive (or neutral)

Trend: is the market in an up/down trend

Price: updates and visibility on where things are tracking

Relative value: comparing absolute and relative prospects

Overall it’s an easy way of quickly and efficiently understanding where the big risks and opportunities are in Australian markets.

Act Now — activate a 7-day trial pass to get instant access to the latest chartbook (+archives) and see if it’s right for you:

Best wishes,

Callum Thomas

Head of Research & Founder

Topdown Charts | www.topdowncharts.com

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

NEW: Other services by Topdown Charts

Topdown Charts Entry-Level — [TD entry-level service]

Topdown Charts Professional — [institutional service]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack — [Gold charts]

Australian Market Valuation Book —[Aussie markets]