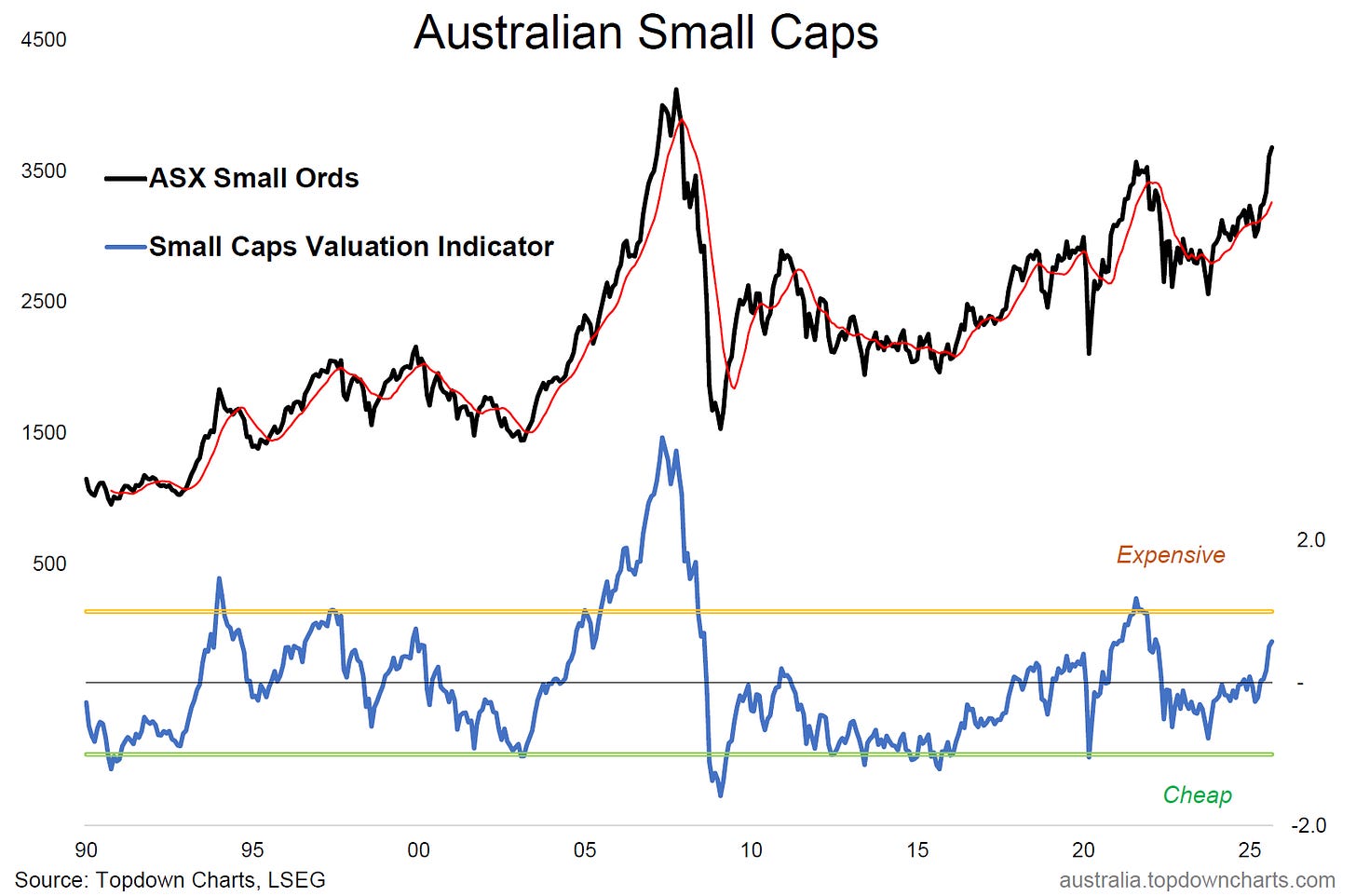

Chart: Aussie Small Caps

Surging small caps have investors asking: is this a risk or opportunity?

Australian Small Cap stocks have had an exceptional run since the April tariff tantrum reset, but what’s behind the recent move —and is it sustainable?

From a technical standpoint Aussie small caps look great, we’ve seen a failed breakdown, a successful breakout to new highs, and overall a solid uptrend being established. This is a clear picture of strength, and the only quibble might be that it looks a little overbought short-term (as markets tend to do during the early stages of new bull markets).

Unlike their US peers, Australian small caps are starting to look somewhat expensive, but from a cycles and market timing perspective we care less about expensive valuations: a. during the early stages of the move; b. when technicals are very strong; and c. if the valuation indicator is high *but not yet extreme*.

Add to this the generally strong price action in global equities (global risk-on sentiment and flows), RBA + Fed rate cuts, and bull market in gold (+improving outlook for commodities and traditional cyclicals) there probably is room to run here. [n.b. the ASX Small Ords has significant exposure to gold miners and traditional cyclicals; minimal exposure to tech].

Key takeaway: Australian small caps are breaking out with strong technicals, and there still looks to be room to run on valuations and macro.

This note was brought to you by the Australian Market Valuation Book

SURVEY …what do you reckon?

About the Australian Market Valuation Book

The Australian Market Valuation Book features exclusive, innovative, and insightful indicators to provide Clarity and Decision support to Australian investors +those who allocate-to or are interested in understanding this market.

Specifically, the pack covers:

Australian Equities (ASX 200, Small Ords, Banks, Resources, sectors, AREITs).

Australian Fixed Income (corporate credit, government bonds, rates)

Other key markets (AUDUSD, A$ Gold, housing)

Capital Market Assumptions (expected returns for the major assets)

The pack focuses on delivering insight into:

Valuations: is the market cheap/expensive (or neutral)

Trend: is the market in an up/down trend

Price: updates and visibility on where things are tracking

Relative value: comparing absolute and relative prospects

Overall it’s an easy way of quickly and efficiently understanding where the big risks and opportunities are in Australian markets.

Act Now — activate a 7-day trial pass to get instant access to the latest chartbook (+archives) and see if it’s right for you:

Best wishes,

Callum Thomas

Head of Research & Founder

Topdown Charts | www.topdowncharts.com

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

NEW: Other services by Topdown Charts

Topdown Charts Entry-Level — [TD entry-level service]

Topdown Charts Professional — [institutional service]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack — [Gold charts]

Australian Market Valuation Book —[Aussie markets]